Disclaimers: This post is heavily inspired by the excellent Veritasium video about Power Laws. I highly recommend watching it here (and their other videos too).

How good is your intuition about risk and reward?

How do you reason about uncertainty? About rare events?

Let’s play 2 games and see which one you prefer.

Game A: Fixed Flips

You get 100 coin tosses. Win $1 for each heads.

Game B: Doubling Game

Start with $1. Each heads doubles your money. First tails, you stop.

The first game is boring. You get a small and almost guaranteed reward. Play 100 times, and you will most likely never win more than 75$ in one game.

On the other hand, the second game is exciting. Sometimes you break the bank with a huge win, sometimes you don’t.

How do you feel about it? Which game would you prefer to play? Which one would you pay more to play?

The Power Law (the light math part)

The first game has a normal distribution of rewards. Most of the time you get around the average reward, and the probability of getting a much higher reward drops off quickly.

The rewards from the second game follow a power law distribution. Most of the time you get a small reward, but there is a slim chance of getting a huge reward. The probability of getting a reward decreases as the reward increases. But it does so in a way that still increases the overall expected value (EV) of the game. If you consider all the possible reward, even the most unlikely, the expected value of the second game (with a fair coin) is infinite!

Think about it for a few seconds… The EV is not just BIG, it is infinite! It means that the rationale thing to do is to keep playing the game forever, even if you have to pay 10$ to play each time! Even if you have to pay 100$… even if you have to pay 1M$! The fee doesn’t actually matter… (as long as you have infinite money to keep playing).

What’s the point?

Many real-world phenomena follow distributions similar to power laws: wealth distribution, earthquake magnitudes, forest fire sizes, and more.

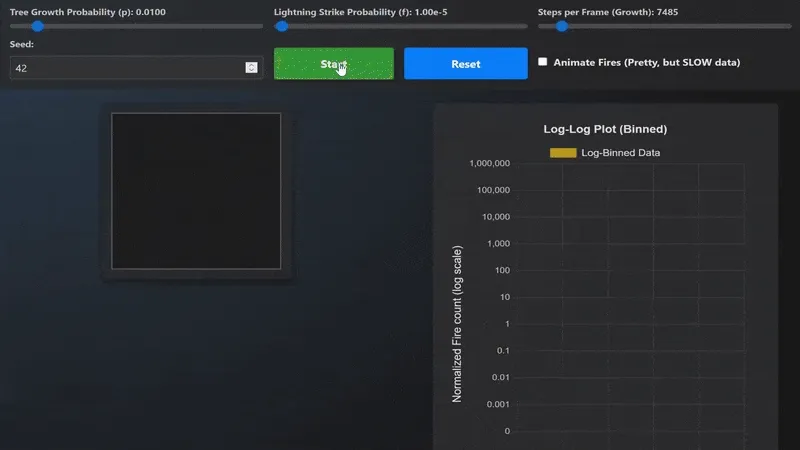

Let’s explore a terrific simulation Veritasium made to illustrate this: Forest fires model (Drossel–Schwabl)

In this simulation, trees grow and occasionally catch fire. Most fires are small, but occasionally, a lightning strike can cause a massive fire that burns a significant portion of the forest. In fact, the distribution of the fire sizes follow a power law.

In this simulation, trees grow and occasionally catch fire. Most fires are small, but occasionally, a lightning strike can cause a massive fire that burns a significant portion of the forest. In fact, the distribution of the fire sizes follow a power law.

Play with it here. It’s more fun than what it looks like.

There are a few other notable examples of power laws in real life:

- Sand piles collapsing (simulation): Sand grains are added one by one to a pile until it reaches a critical state, leading to avalanches of various sizes. The sizes of these avalanches follow a power law distribution.

- Wealth distribution (resource from the University of Florida): “Pareto proposed via statistical analysis that 80% of a countries wealth is held by about 20% of the people”.

- Stock market returns

- War casualties

- …

But why are they appearing “everywhere”?

Some say power laws emerge from self-organized criticality. Systems evolve to a critical state (trees grow, sand piles accumulate, …) where minor events can lead to consequences of any sizes.

This idea was very much developed by Per Bak, Chao Tang and Kurt Wiesenfield in their 1987 paper

Once you know about “self-organized criticality”, you start to see it everywhere, especially when humans are involved.

- Many people accumulate unaddressed emotions over time and minor events can trigger massive emotional outbursts.

- Companies accumulate technical and organizational complexity and minor incidents or mistakes can lead to catastrophic failures.

- Societies accumulate tensions and minor events (a small fuel tax increase) can spark large-scale outrage (Gilets jaunes movement) (If you are from the USA, consider the impact of the death of George Floyd).

- Our economic system creates business opportunities over time. It’s quite similar to the simulation above that keeps creating trees. And every new product launch, every startup creation is a lightning strike. Some fire stays small, some completely changes the landscape.

What’s the point?

Real life™ is more complex than what we are comfortable with. So, no sadly, you can’t rely only on this newly acquired knowledge to guide every choices you make. This is as bad an idea as learning history to predict the future.

BUT if history never repeats itself, it often rhymes.

What actionable insights can we draw from this knowledge about power laws and self-organized criticality?

- The number of tosses matters. This is what online coaches mean when they say “create your own luck” or some variant of it. This is partially why your network is so valuable. The more exposure you have, the more tosses you are susceptible to take part in.

- As nobody has infinite resources to keep playing (time, money, energy), any edge available to improve your odds is worth much more than what you think (try my mini-games again to see it in action). Use all your wisdom, all your intuition, all your experiences so that the coin you are considering to flip has more than 50% chance to land on heads.

- Most attempts will fail. There is no way around it. Being at peace with failure seems like a requirement to play the game.

This blog post and this website were motivated by this very idea. This is one of my first tosses. I’ll let you know how it goes.